Sustainable Investing

Our Sustainable Investing options use an asset allocation approach that selects Exchange-Traded Funds (ETFs) and Mutual Funds that incorporate Environmental, Social and corporate Governance (ESG) factors into the investment screening process.

Risk and Opportunity

Much of investment management is about risk management, so determining and managing all areas of risk is essential. Our approach to providing sustainable investing options to clients is not simply a feel-good exercise, it’s based upon using investments that add layers of research that bring environmental, social, and corporate governance exposures into the risk management equation.

Risk

From a risk management standpoint, successful companies may be able to mitigate their business risk and improve their long-term probability of success by directly addressing areas such as pollution, employee relations, climate change, and more.

This focus is creating new opportunities for corporations to save money by reducing “controversy” risks through more responsible operations.

Opportunity

World economies have experienced several revolutionary economic stages throughout history, with the first industrial revolution of mechanization, then science and mass production, followed by the digital age, and now the information age. Circumstances have now demanded a new perspective on the interaction of business and society that considers the broader long-term benefits and costs. This recognition is creating incentives and opportunities in areas such as clean energy, transportation, waste management, building, and employee relations.

ESG Integration: A Best-In-Class Approach

ESG Integration is the systematic and explicit inclusion by investment managers of Environmental, Social, and corporate Governance factors into financial analysis.

– Global Sustainable Investment Alliance

Inclusionary vs. Exclusionary

Previous “socially responsible” investing strategies were primarily exclusionary, focused mostly on avoiding industries such as tobacco, firearms, and gambling. ESG investing has a slightly different approach. It utilizes a research process whereby ESG criteria are specifically incorporated into investment analysis. So instead of being simply exclusionary, the analysis is now also inclusionary, resulting in investment selections that represent ESG “best-in-class” selections within industries and sectors.

ESG Areas of Analysis

Environmental

- Climate Change

- Carbon Footprint

- Clean Energy

- Green Building

- Pollution Control

- Waste/Recycling

- Sustainable Agriculture

- Water Resources

Social

- Labor Relations

- Workplace Safety

- Diversity

- Community Development

- Human Rights

- Product Safety

Corporate Governance

- Board Independence

- Anti-Corruption Policies

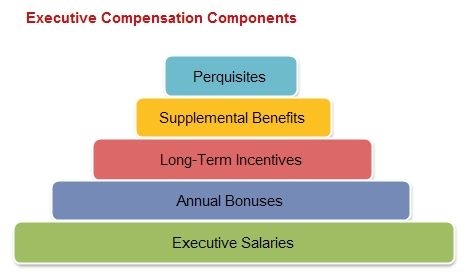

- Executive Compensation

- Corporate Political Contributions

- Controversy Risks

- Ethics

A Brief History of Sustainable Investing

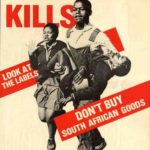

Values-based investing goes back thousands of years, including traditions in Jewish law, the Quakers, Methodists, and Islam. But the current form of sustainable investing took shape in the 1960s, with Vietnam War boycotts of weapons manufacturers, and the creation of community investment to address social inequity. While the 1970s saw a growing awareness of the health risks of pollution and threats to the natural world, the antiapartheid movement of the 1980s may have been a watershed moment. It showed how direct company divestment could play a role in effecting positive social change. Then in the 1990s, the previous decade’s events such as Chernobyl, Bhopal, and the Exxon Valdez highlighted corporate responsibility issues. By the 1980s, mutual fund companies took notice, and the first “Socially Responsible Investing,” or SRI mutual funds began to appear, as well as the first SRI index, the Domini Social 400.

The 2015 Paris Climate Accord has given additional impetus for governments and companies to directly address the long-term economic, social, and environmental risks of climate change.

How do Sustainable Investments Perform?

In recent years, multiple surveys have found that a majority of investors are interested in sustainable investing. But many may have been hesitant to act due to the perception that sustainable investments underperform. That opinion often arises when the term “sustainable” is confused with the early “socially responsible” investing approaches of the 1990s, which followed an exclusionary approach. With new, more robust, and increasingly systematic processes and more investment offerings, clients are now better able to obtain exposure to the risk and return characteristics of most market indexes.

BlackRock Announces ESG Focus:

In January of 2020, the world’s largest asset manager implemented initiatives to incorporate sustainability metrics into their portfolio construction processes.

Asset Allocation and ESG

Sustainable Investing strategies may or may not be appropriate for you. Our process is to make available this option to those clients who are seeking a way to invest their money in a way that is responsible environmentally, socially and ethically. In choosing investments for all strategies, our overarching goal is to seek an appropriately diversified allocation to asset classes that minimizes expected risk for a given expected return. This means that if a sustainable investment option is unavailable for a recommended asset class, we may utilize non-ESG investments to represent that asset class. This process ensures that the target asset allocation is maintained and remains the primary driver for client risk and return.